Arizona Home Sale Documents

We endeavor to maintain current versions of all documents on this website but there may be a time gap between when a document update is released and when we get it uploaded here. Samples of the current official documents are available for review and/or download here:

Listed below are the primary documents involved in an Arizona residential real estate sale/purchase. As you may see on the above source links, these are just a few of the many forms potentially involved, but these are involved in very nearly all such transactions.

The Listing Agreement originates with ARMLS, the Arizona Multiple List System, and is relevant only to Realtors® for use. All the other documents originate with the Arizona Association of Realtors®, AAR, and are available for purchase by the public at a nominal fee

… here … AAR Documents for Purchase

|

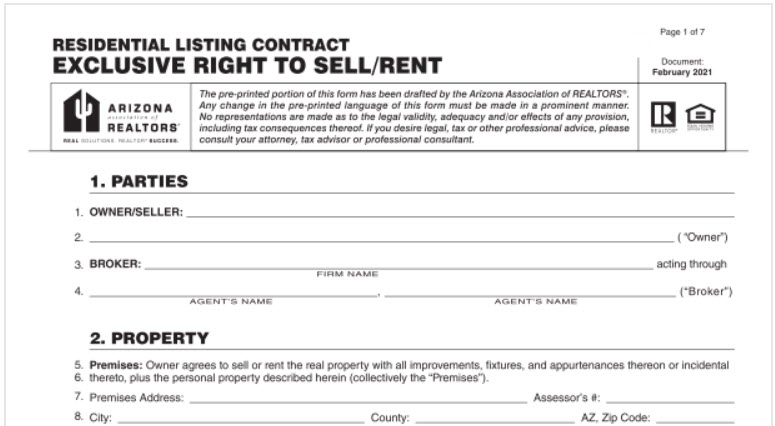

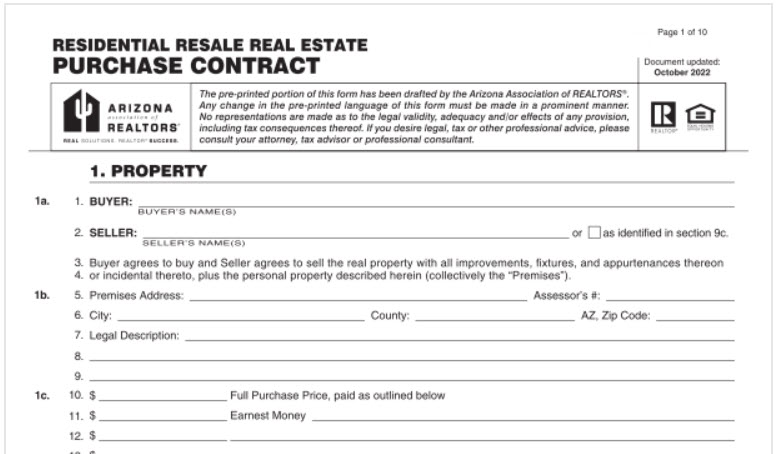

Listing Agreement Purchase Contract |

The Listing Agreement is the contract between the listing agent/broker and the owner/seller. It is currently seven pages. The Purchase Contract is the primary agreement between Seller and buyer. It is currently ten pages. To fully explain either form would require a separate website for each. The discussions below are quite superficial. Have your Realtor® take you through each to get a decent understanding. |

| SPDS Seller Property Disclosure Statement BINSR |

These two documents are so vital to an Arizona home sale/purchase, and so complex, that there is a separate page on this website for each.

Click the respective link to transfer to that discussion and a link to a sample form. |

|

These documents are discussed below. The last two are not often used but are discussed below because of the importance of the situations involved when they are used. |

Listing Agreement – the seller is agreeing here to a good number of issues regarding access, condition, security and other aspects of the property all of which are important to the success of the sales effort. Highlighting these would provide a good starting checklist for preparation and presentation of the property.

Sellers need to be fully aware of the commission to be paid to the buyer’s broker by the listing broker as specified in Section 6 of the Listing Agreement. Some listing agents may offer less than 50% of the total commission to buyer brokers. To some degree, this may be a detriment to “traffic” to the property. A reduced commission offering to buyer-brokers is NOT in the seller’s best interest.

Purchase Contract – the core of an offer and the eventual primary contract document between seller and buyer. For an overall grasp of the nature of this document, consider that:

- it has evolved over decades.

- changes from one version to the next have varied from the relatively minor to a 50% increase in the number of total pages

- it is an AAR document … Realtors® are commonly on both sides of the transaction, so it is intended to be generally “fair” to both sides

- although “fair”, this contract is VERY biased in favor of the buyer, who has a half-dozen contingencies, some potentially frivolous, through which buyer can cancel the contract. The seller has no contingency as long as the buyer conforms to the terms and conditions of the contract.

- also, the contract can be filled-in by the buyer, or modified by addendums, to be very one-sided

- the AAR contract is involved in a very large number of transactions on an ongoing, everyday basis so it “works”

… in terms of coverage of the issues and being consistently “understood” by people in the industry.

In evaluating purchase offers, sellers should consider the sincerity of the buyer first and foremost … price should not be first. Considering all factors and issues … how likely is the buyer to close the deal? Difficult as that assessment may be, if the conclusion is that the buyer is likely not to be able, or is likely to not be willing for some apparent reason, to ultimately close, it may be wise to reject the offer … irrespective of the price. This is especially true when dealing with a “flipper”, or in a short sale situation.

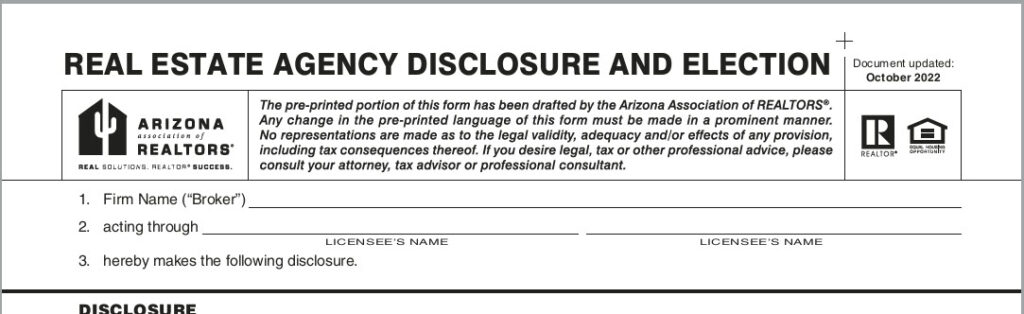

Agency Disclosure and Election – This form discloses/explains the duties of the the Broker/Agent to the client and provides a written means for the client, buyer or seller, to make a choice for the nature of representation the Broker/Agent is to provide. It does NOT obligate the client in any way.

- The top section of the form identifies the real estate parties, organizations and people, that the choices pertain to.

- The center section discloses/explains the Broker/Agent duties that are involved in each choice.

- In the bottom section the client indicates what his/her choices are, and signs to validate the form.

Most commonly, the Buyer will select the choices at lines 35 and 37, so as to be shown all properties that meet his/her criteria irrespective of who the listing Broker is. The buyer would never select the choice at line 36.

Most commonly, the seller will select the choices at lines 42 and 43, to indicate that the property is to be offered to all buyers irrespective of who may be the buyer’s broker. The seller would never select the choice at line 41.

As noted on the form at the bottom of the DISCLOSURE section, for any choice that a buyer or seller makes, the Broker/Agent is required to:

- exercise reasonable care and diligence

- maintain the confidentiality of their clients.

- never discriminate with respect to the classes of people identified in the Fair Housing Act.

- promptly present all written offers/counter offers to their client.

- answer all questions truthfully.

- disclose all material facts that they know or should know relating to a property.

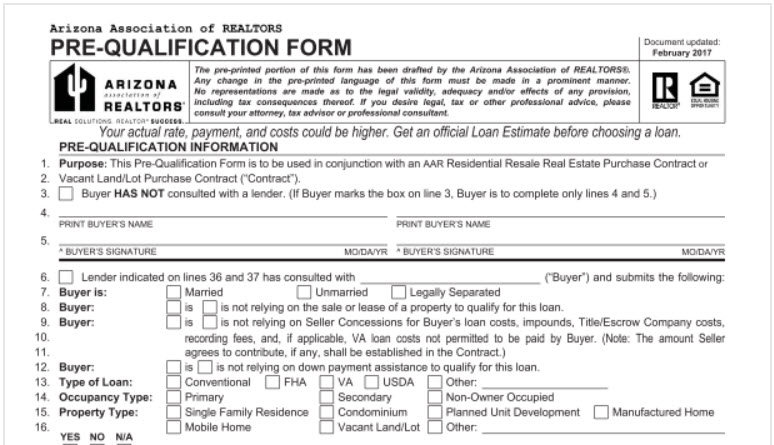

Buyer Loan Pre-Qualification form – is submitted with a purchase offer that involves financing. The quality of the “pre-qualification” can vary tremendously. The form can indicate, for example, that very little has actually been done to determine the financial capacity of the buyer. If so, the buyer needs to be told to go get a Pre-Qualification that means something. In any case, a diligent listing agent should call and interview the lender issuing the Pre-Qualification to get some feel for the quality of this document and the true financial capacity of the buyer.

Buyer Loan Status Update – For home purchases that are to be financed, this form is VERY important to the seller. For a 30 to 45-day escrow, this form should be updated to both buyer and seller at least weekly. For a shorter escrow period, it should be updated daily.

The top part of page 1 presents the basic information regarding the lender, buyer and the property. The middle section presents information about the buyer that is relevant to the loan being sought, the amount the buyer qualifies for, and loan details.

At the bottom of page 1, starting at Initial Documents Received, and for all of page 2, the lender is reporting the status of loan processing … what the lender has done so far to justify providing the cash that would enable the buyer to close on the purchase.

A very important item is #53, Lock expiration date. It is critical that this date be on or after the scheduled close date.

The most critical item is #62, Buyer has loan approval without PTD Conditions, i.e., all conditions for loan approval have been met.

Buyer-Broker Employment Agreement – The Neal Team, TNT, has no need for use of this Contract with a buyer client, so this discussion provides little insight to the form.

First, the TNT #1 goal is to earn the client’s trust for “My Realtor!”. A contract would add nothing toward achievement of that goal.

Second, the TNT intent is to exceed every client expectation. We ask questions and carefully listen to know what those expectations are. A contract would add nothing to that.

Lastly, TNT never charges any sort of up-front fee. Nor have we ever charged a buyer client any sort of commission. This eliminates the primary purpose of contract … money issues. TNT is paid by the escrow company when/if a transaction closes as a reduction in the net cash to the seller. Period!

The exception that could arise, but never has, is the case where the seller is a FSBO – For Sale by Owner. The TNT approach there would be to negotiate a buyer-specific agreement with the seller, and discuss the situation thoroughly with our buyer client. In any case, if the client wishes, we would show the home and provide full services to the client, whatever the outcome.

Consent to Limited Representation – In Arizona, a theoretical conflict of interest arises when the same brokerage represents both the buyer and the seller in a transaction. This is true because per the State, the Listing Agreement is actually between the seller and the brokerage, not the agent, and the primary agency relationship for the buyer is first with the brokerage “through the agent”, using the Agency form language.

The conflict is nearly always theoretical because different the agents are involved for the buyer vs. the seller. In such cases, there would simply be no conflict.

But even there, the State of Arizona requires that the Consent form be signed by both seller and buyer.

Since several Arizona brokerages are quite large, each having many associated agents, there is an increasing possibility that this form would be required.

The situation where the conflict potential is real is where a buyer wants to purchase a property listed by their buyer agent. That agent must become a strictly neutral party … giving no advice to ether side and maintaining confidential information absolutely. This would be a very difficult situation for all parties.

For information, guidance, services, questions …

Give us a call! We’re here to help.

No strings … no obligations!

Call today! You’ll be really glad you did.

Other Arizona Homeowner Issues