You can’t buy or rent what’s not on-market

Net in-migration is facing a low homes inventory in metro-Phoenix, both new and resale homes.

According to the Census Bureau, Maricopa County had the highest net growth in population, actual number of people living here, consistently every month for 5+ years starting January 2016. There was a pause in the COVID period, but it resumed. In recent months the national ranking has declined but it’s still high and the number of people moving here is still quite large.

At an average of three people per living unit, the number of new housing units needed per years is 10,000+. That is a rather shocking number of new homes even for a metro area that’s about 80 x 60 miles east-west/north-south with a population approaching 5 million.

rather shocking number of new homes even for a metro area that’s about 80 x 60 miles east-west/north-south with a population approaching 5 million.

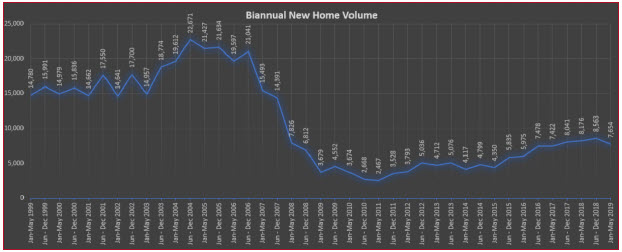

A big problem … new construction of single-family units is coming off the low point for the last two decades.

As illustrated by the chart below, from 1999 through 2003, Maricopa County had 14,000 to 17,000 homes built every six months. In 2004 through 2007, new construction exploded, going to 22,000+ in the second six-months of 2004. The 2008 recession drastically reduced that activity, and it has not come back very far.

The fundamental problem is the absence of skilled construction workers. A great many went to other forms of employment in the face of the housing recession and have not come back.

Multiple-housing units, apartments, are being built at an all-time-high rate, taking up some of the slack.

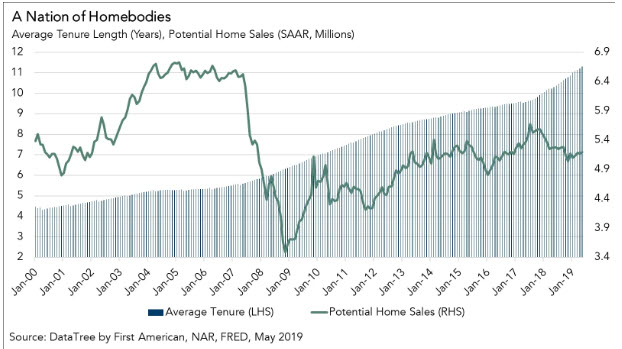

However, as has been widely reported in industry literature, homeowners are less frequently selling and moving. As illustrated in the chart below, average tenure nationally grew from about 4.5 years in 2000 to 11+ years in the first half of 2019. The trend has continued.

These supply verses demand factors largely resulted in a “zero-sum” effect for quite a while. Supply, the number of homes listed for sale, is near modern-time lows and demand is driven only by new arrivals.

But not now! The demand side has resumed its usual dominance locally and the “the law of supply and demand” has come back into play. Since mid-2022, prices have increased sharply.

Unless interest rates go back down to unusually low levels and/or residents get back their moving inclination, the supply of homes available to purchase is going to increase slowly for the foreseeable future.